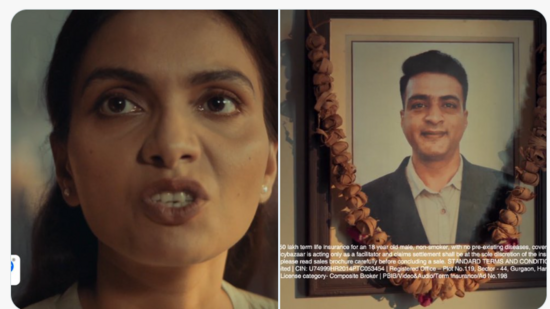

Policybazaar, one of India’s leading insurance aggregators, has found itself at the center of a social media storm due to its latest advertisement promoting term life insurance. The ad, which was aired during the high-profile India-Pakistan ICC Champions Trophy match, has drawn severe backlash for its allegedly insensitive approach to financial planning and insurance awareness.

The Ad That Sparked Outrage

The controversial Policybazaar ad features a widow who appears distressed over her late husband’s lack of financial foresight. She expresses frustration about managing household expenses and paying for her child’s school fees, emphasizing that her husband failed to buy term insurance. While the intent was to highlight the importance of financial planning, the execution has not gone down well with viewers.

Many have criticized the ad for being overly dramatic and tactless, as it seemingly blames a deceased man for his family’s financial struggles rather than focusing on a more constructive message about the benefits of insurance.

Public Backlash on Social Media

Social media users have been vocal in their criticism, with many calling the advertisement “insanely insensitive” and “tone-deaf.” Some users expressed their disbelief, arguing that using grief and loss as a marketing tactic for insurance crosses ethical lines.

One user on X (formerly Twitter) commented, “A man just passed away, and the first thing his wife does is blame him for not buying term insurance? This isn’t financial awareness; it’s just insensitive storytelling.”

Another remarked, “This ad is disgusting. Instead of showing support and hope, it portrays a grieving widow as resentful. Policybazaar really needs to rethink their strategy.”

The Ethical Dilemma in Insurance Advertising

This controversy raises a larger question about the ethics of advertising in the insurance sector. While the intent behind the ad—to encourage families to invest in financial security—is valid, the approach has been criticized for exploiting grief. Brands dealing with sensitive topics like life insurance need to balance urgency with empathy, ensuring that their messaging does not come across as emotionally manipulative.

What’s Next for Policybazaar?

As the backlash grows, it remains to be seen whether Policybazaar will issue an apology or pull the ad from circulation. Given the increasing scrutiny on brand ethics, companies must tread carefully when addressing topics related to death, financial stress, and family security.

Conclusion

While insurance is an essential financial tool, its promotion must be handled with care and sensitivity. Policybazaar’s latest ad serves as a reminder that impactful storytelling must not only be persuasive but also considerate of public sentiment. As brands strive to educate consumers about financial planning, they must ensure their messages are framed in a way that resonates positively rather than sparking controversy.